For roughly 1/4 of Americans work can feel demoralizing, frightening, and traumatic. The 2023 American Psychological Association’s Work in America Survey reports that 19% of respondents consider their workplace toxic; and 22% say their toxic workplace harms their mental health.

It’s a colloquial metaphor, Toxic Workplace, used to describe a place of work that impacts an employee’s health. The U.S. Surgeon General alights in a new framework for Workplace Mental Health and Well-Being. “Chronic stress from workplace abuse” Vivek H. Murthy writes, “can lead to depression, heart disease, cancer, and other illnesses.”

However, chronic stress and abuse has existed since the feudal labor society amalgamated into the modern civil labor movement. These concerns aren’t new but there is a new point of view. Toxic workplaces affect their economies, too.

While the Egyptians didn’t have unions, a look at 730 Third Avenue in 2023 offeres insight why.

TIAA

The Carnegie Foundation for the Advancement of Teaching (CFAT) was founded by Andrew Carnegie, and chartered by an act of the United States Congress in 1906. Among its most notable accomplishments are the development of the Teachers Insurance and Annuity Association (TIAA). For over 100 years, TIAA has been a private provider of financial retirement services in the academic, research, medical, cultural and governmental fields.

It’s a Fortune 100 company with $1.2 trillion in combined assets under management; 4.7 million customers; and 12,000 insertional clients. Why their different? TIAA serves non-profit institutions & their employees. Since 1905, they’ve innovated, evolved and expanded their business to become the recognized leader.

TIAA bought 730 Third Avenue in 1955, later expanding with major offices in Denver, Charlotte, Dallas and 70 local offices throughout the U.S. In 2018, TIAA ranked 84th on Fortune's list of the 500 largest corporations in America. TIAA is the largest global investor in agriculture, the second-largest grower of wine grapes in the United States, and the third-largest commercial real estate manager in the world.

State Street

Founded in 1792, it is the second-oldest continually operating United States bank with US$40.0 trillion under custody and administration in 2023. The Financial Stability Board calls this bank “too big to fail.”

730 Third Avenue in Manhattan

State Street Global Advisors (SSGA) is their investment management division and the world's fourth largest asset manager, with nearly $4.14 trillion (USD) in assets under management. The company services financial clients by creating and managing investment strategies for governments, corporations, asset managers, financial advisors and other intermediaries around the world. They service endowments and non-profit foundations, too.

In 2017, SSGA commissioned a statue by Kristen Visbal called Fearless Girl, and supplanted it in Manhattan’s Financial District before Wall Street's Charging Bull. The statue commemorates an index fund which comprises gender diverse companies that have a higher percentage of women among their senior leadership. *Sidebar: In March 2017, SSGA agreed to pay over $5 million in back pay and interest to settle allegations the company had systemically underpaid women.

In 2018, State Street completed its acquisition of Charles River Development (CRD): a Boston based portfolio of investment management software. The deal closed at $2.6 billion in Q4 and was financed by the suspension of share repurchases; triggered a drop in State Street shares of nearly 10 percent; called for 2300 domestic layoffs, and concurrently hired 3,000+ in China and India. One more thing:

Immediately following State Street's acquisition of Charles River Development, State Street (SSGA) began selling its newly acquired products and services (CRD) to its own clients and pension funds (TIAA) in perpetuity.

Gospel of Wealth

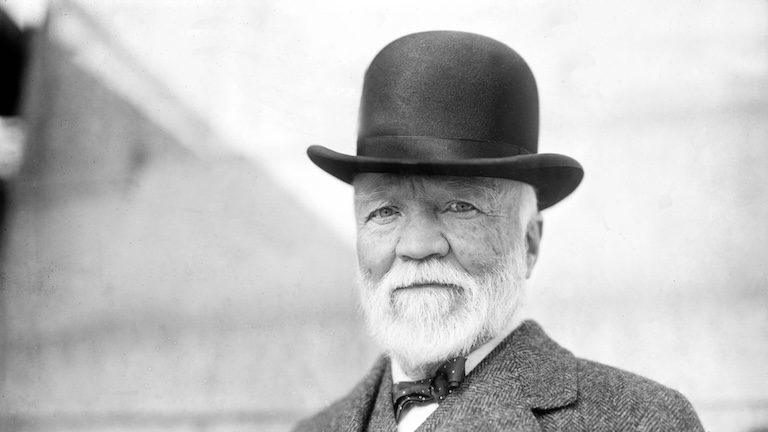

When Andrew Carnegie sold the Carnegie Steel Company to J.P. Morgan in 1901, he surpassed John D. Rockefeller as the richest American of all time. During the last 18 years of his life, he gave 90 percent of his 350 million fortune to charity.

His 1889 missive "The Gospel of Wealth" in the Pall Mall Gazette called upon the nouveau riche of the Gilded Age "to distribute their excess wealth to improve society." The steel magnate devoted the remainder of his life to large-scale philanthropy, including: 2,500+ Carnegie Public Libraries, Carnegie Melon University, and Carnegie Hall. However, is idiosyncratic large-scale philanthropy the most equitable distribution of wealth?

Life Magazine acknowledged Carnegie's hold on the American psyche, but "questions whether the Pittsburgh steelmaker’s huge charitable donations would have been better spent on higher wages, improved working conditions, and pleas for an 8-hour (rather than 12-hour) workday?"

Andrew Carnegie

The article led to searing pushback from New York elites, industry leaders, and, in particular, British Prime Minister William Gladstone who vehemently defended capitalism, market economies, a private sector and individual wealth.

The criticisms led the Scotsman to publish a series of rebuttals. Carnegie defended individualism, private property, and the accumulation of personal wealth in subsequent articles. "In bestowing charity, the main consideration should be to help those who will help themselves," he wrote, but should society be relegated to charities to do the work of social justice?

Charging Bull

By 2023, the U.S. banking sector would experience a loss of over $38 billion in profits during Q4, with a year-over-year decrease of an unprecedented 45 percent. It’s the largest year-over-year quarterly profit decline since the onset of the COVID-19 pandemic in 2020. Still, American banks collectively managed to increase their earnings by 2 percent to $256 billion. Heres how.

In 2023, some of the country's largest banks expensed $16 billion to replenish a deposit insurance fund that had been strained by 3 U.S. bank failures. Bad loans led to another $4 billion loss on banks' security portfolios; triggering lenders to reduce their workforce as part of restructuring efforts; offshore nearly 3000 American jobs to China and India; and pushing their own products and services on their clients.

Whether or not "State Street Bank is a toxic workplace,” as many we spoke to claim, its at least worth considering Carnegie's amended point de vue. “No man can become rich without himself enriching others,” was his original phrase. However, now we "help those who help themselves” its how its said nowadays.

Afterword

Fearless Girl was first installed to face down the Charging Bull statue on Wall Street in 2018. But following complaints from Charging Bull's sculptor, Arturo Di Modica, she was removed, redistributed, and relocated to Broad Street > across from the New York Stock Exchange > in the Financial District in New York City > and before and in behalf of the institutions of Main Street.