Dave Landy

He had a front row seat at the Global Financial Crisis. Dave Landy joined Charlatan in 2009 as a Business and Finance Editor.

Dave Landy

As the Director of Investments Technology at Evergreen Investments, Dave Landy was among the ranks of the top 25 largest mutual fund families in the United States, and 30 largest asset management companies in the world. Founded in 1932, the Wachovia Global Asset Management company had 83 mutual funds, 2.7 million mutual fund shareholders, and nearly $250 billion in assets under management in 2007.

During the 2008 Global Financial Crisis, Landy had a front row seat to the most severe worldwide economic crisis since the Great Depression. Predatory lending in the form of subprime mortgages targeting low-income homebuyers, excessive risk-taking by global financial institutions, and a continuous buildup of toxic assets within banks ultimately burst the United States housing bubble, culminating in what WSJ called the "perfect storm of the Great Recession.”

A segue to PRIM, the newly christened CTO oversaw the state pension fund clear $100 billion for the first time, as a diversification of managers held and invested nearly $11 billion on behalf of Massachusetts pensioners. In 2018, he was tapped to oversee the technology functions for nearly 100,000 students in the Denver School System. As Chief Information Officer, Landy single-handedly spearheaded providing internet access to all.

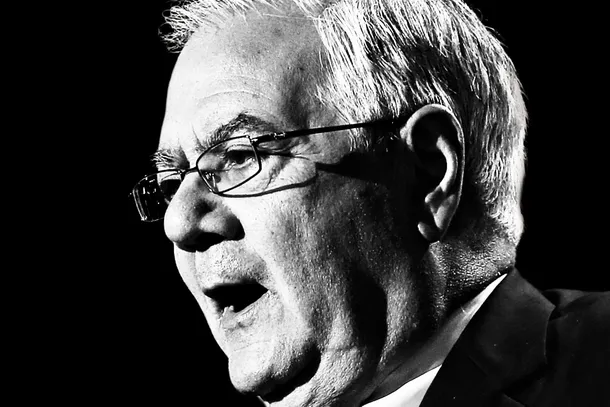

With a BS in Finance/Economics from Bryant, and MBA from Babson, Landy joined Charlatan Magazine in 2008 to interview Shell Oil President John Hofmeister. A visionary who called for a less insular and more inclusive Energy Sector, Landy quickly reprised with Rep. Barney Frank. Chairman of the House Financial Services Committee in 2008, Landy was among the first tranche of journalists to uncover Washington’s role, lack of oversight, and complicity in the Global Financial Crisis.

Articles by Dave Landy

Why We Hate the Oil Companies

He managed the portfolio, profitability and people of the Shell Oil Company. Contributor DAVE LANDY sits down with the Texas oilman to discuss his controversial memoir "Why We Hate the Oil Companies."

Master of the House

Chairman of the House Financial Services Committee in 2008, Rep. Barney Frank sits down with DAVE LANDY to explain Washington’s role, lack of oversight, and complicity in the Global Financial Crisis.

Archives